It is unlikely there will be a similar automatic extension for 2020 returns filed in the 2021 filing season, but anything can happen so monitor IRS activity in this regard.

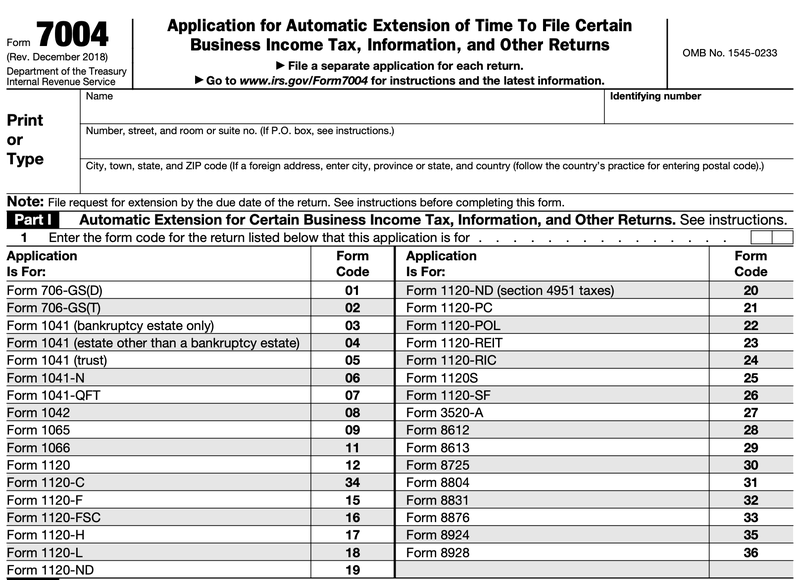

C corporations, S corporations, and partnerships use Form 7004 to ask for an extension.Reality: While there are some situations that result in automatic extensions (explained later), in most cases, to get an extension, you need to request one no later than the original due date of the return.

Myth: No action is required to obtain a filing extension. Again, whatever the reason a business may have for wanting an extension, it isn’t relevant to asking for and obtaining more time to file. Common reasons why extensions are used are missing records needed for return preparation, busy CPAs or other tax return preparers, or just procrastination. Reality: You don’t need a reason or give any reason to the IRS when requesting a filing extension. Myth: You need a good reason for requesting a filing extension. Here are 5 myths…and the realities of filing extensions.

0 kommentar(er)

0 kommentar(er)